Introduction to Rewards

Rewards is part of the Retail Banking suite of products and addresses multiple areas of client concerns.

- Increase customer retention in an increasingly fluid and commoditised market.

- Inducements to customer behavior (providing regulatory information, changing interaction patterns to reduce bank costs).

- Incentives to increase client wallet (loyalty) share through encouraging involvement in additional products.

- Improves the bank’s profiling or customer intelligence facilities by increasing client involvement with bank.

Loyalty programs are adopted in multiple industries for the above reasons. Also, with the increasing commodification trends in the banking industry, there are compelling reasons for banks to wish to have a loyalty program.

By creating a suite of products, which are defined and configured in the Arrangement Architecture structure and negotiating certain details individually the Arrangement created with the customer can be unique.

There is no restriction to the amount of rewards Arrangements that an individual customer can have but in normal practice there would generally only have maximum one with each provider.

The Rewards Product Line uses most of the functionalities that are used by the Agent Product Line.(Product Commission and Agent Commission Property Classes or the TSA.SERVICE XXX or AA.AGENT.COMMISSION.SERVICE)

Read the Agency Commissions user guide for more information.

The benefits the bank receives by adopting to loyalty programs is that, it can,

- Differentiate itself from other banks.

- Offer incentives to attract new customers and businesses.

- Create alternative revenue stream by leveraging payment intermediation.

Configuring Rewards

The following section describes the setting up of Rewards.

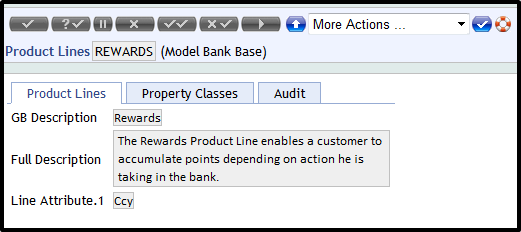

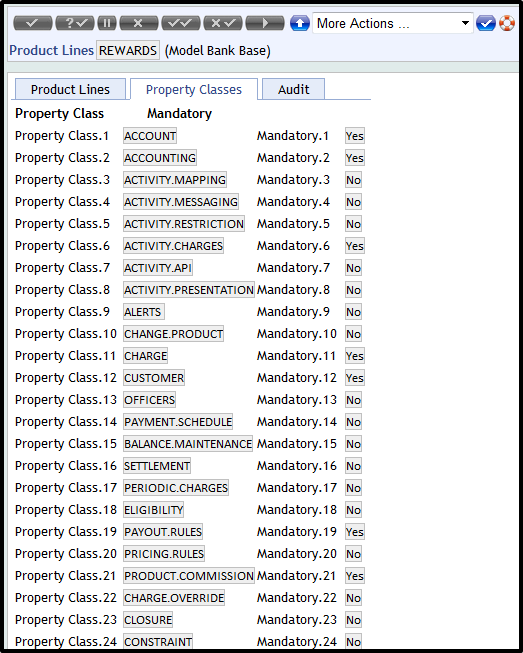

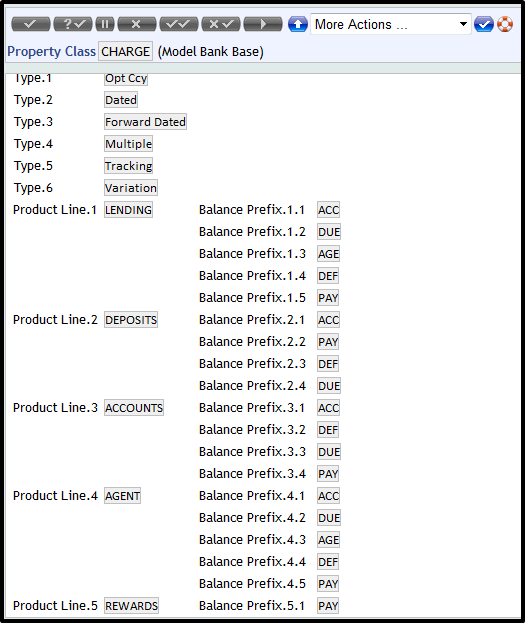

The AA.PRODUCT.LINE table provides a high level definition of the business components (Property Classes) that can be required to construct a Product belonging to that line.

- The Product Lines are defined by Temenos and cannot be amended by the user.

- A Product Line is described by the Property Classes, which constitute it.

- A financial institution may then use these building blocks of functionality to construct the individual Products, which is made available for sale to its customers.

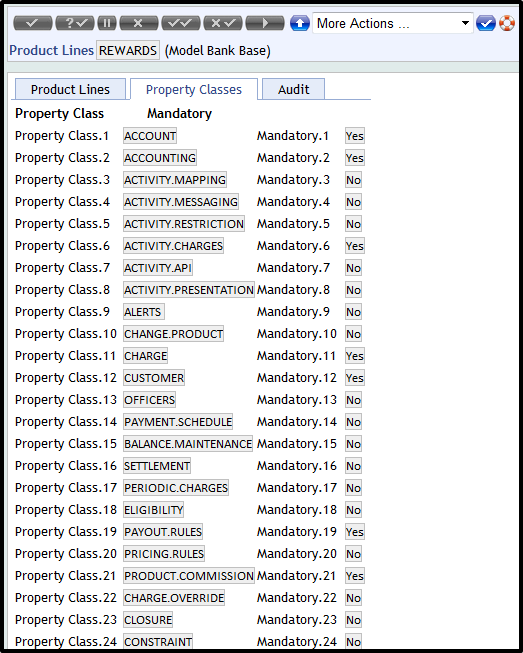

| ACCOUNT | CHANGE.PRODUCT | PAYOUT.RULES |

| ACCOUNTING | CHARGE | PRICING.RULES |

| ACTIVITY.MAPPING | CUSTOMER | PRODUCT.COMMISSION |

| ACTIVITY.MESSAGING | OFFICERS | CHARGE.OVERRIDE |

| ACTIVITY.RESTRICTION | PAYMENT.SCHEDULE | CLOSURE |

| ACTIVITY.CHARGES | BALANCE.MAINTENANCE | CONSTRAINT |

| ACTIVITY.API | SETTLEMENT | STATEMENT |

| ACTIVITY.PRESENTATION | PERIODIC.CHARGES | |

| ALERTS | ELIGIBILITY |

Refer the AA Product Builder user guide for more information.

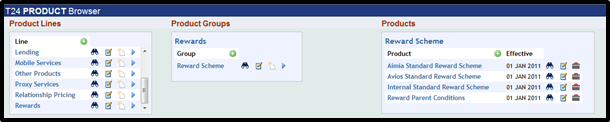

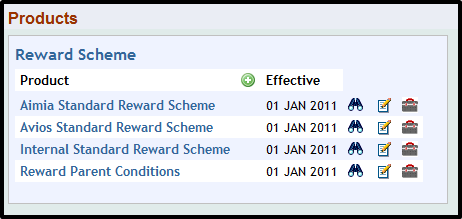

- For example, the Rewards Product Line enables users to design and service rewards products such as:

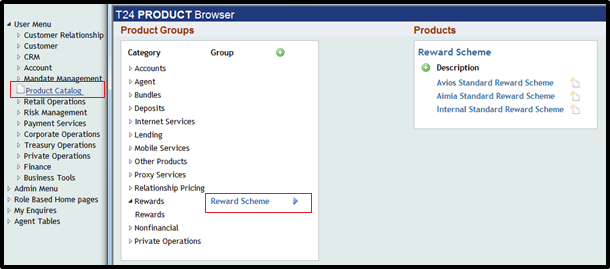

- Aimia Standard Reward Scheme

- Avios Standard Reward Scheme

- Internal Standard Reward Scheme

- Specific user defined Products

- The Product Lines are defined by Temenos and cannot be amended by the user.

- A Product Line is described by the Property Classes, which constitute it. A financial institution can use this functionality to construct the individual Products, which are available for sale to its customers.

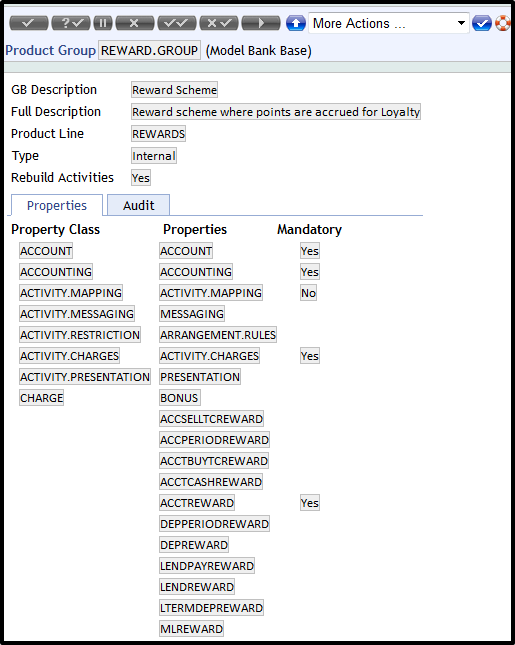

- The above screenshot displays the AA.PRODUCT.LINE record, which contains a complete list of AA.PROPERTY.CLASS records that can be included in a Reward Product. The minimum required classes are marked as mandatory YES and the remaining ones are optional and are marked as NO.

- The mandatory classes govern the minimum required components when creating a new Product in the subsequent AA.PRODUCT.GROUP and AA.PRODUCT.DESIGNER records.

- A particular Property Class may not be mandatory at a Product Line level but the option can define mandatory classes at the AA.PRODUCT.GROUP stage, which further controls the overall consolidated mandatory classes per Product defined.

- Similar to Agent, the points type payments made to a customer are defined in the Charge Property Class. The Property Type must be COMMISSION.

- Read the Agency Commissions user guide for further information.

- The Activity classes used in the Reward Product Lines are similar to the ones used in Agent Product Line, such as REWARDS-RECOGNIZE-PRODUCT.COMMISSION, REWARDS-TRIGGER-CHARGE, REWARDS-TRIGGER-CHARGE*MONTHLY etc.

- Read the Agency Commissions user guide for further information.

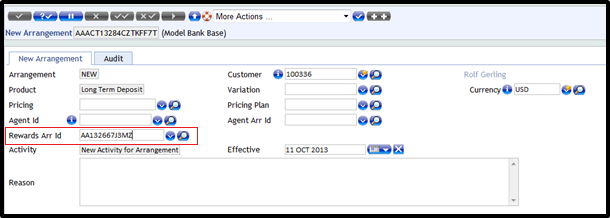

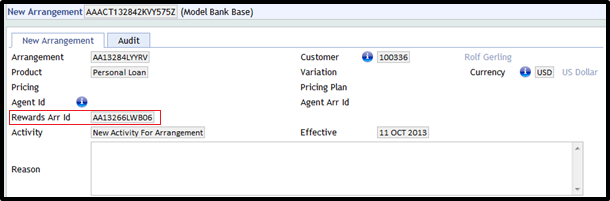

- When either a new financial Loan, Deposit or Account Arrangement is created, the Rewards Arr Id field has to be specified.

- The following screenshot shows an AA.ARRANGEMENT.ACTIVITY record with the Rewards Arr ID field.

Once the system validates this record, the system then automatically creates the AGENT.COMMISSION Property using the Product Commission values associated with the rewards Arrangement.

- The Product Commission Property Class is designed for Agent Product Line. Read the Agency Commissions user guide product section for more information.

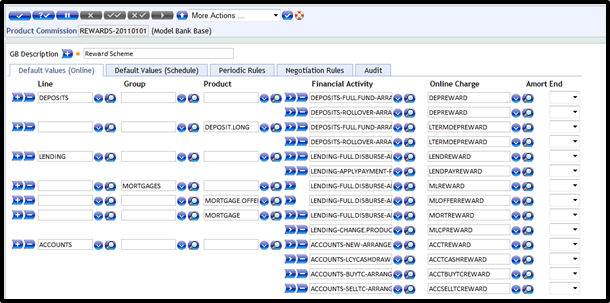

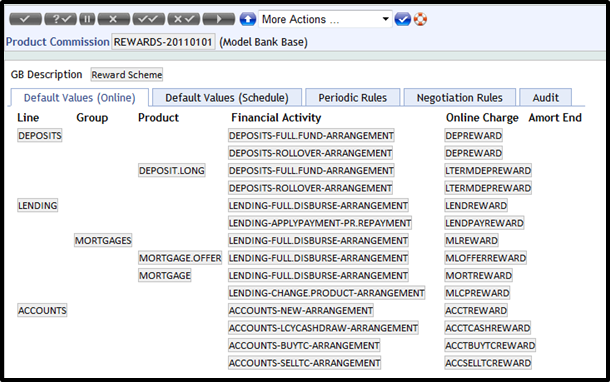

- The LENDING-FULL.DISBURSE-ARRANGEMENT and DEPOSITS-FULL.FUND-ARRANGEMENT Activity Classes are introduced to pay rewards (and also commission).

The bank pays rewards to its customer, in the Lending Product on a financial Activity called LENDING–FULL.DISBURSE-ARRANGEMENT.

The bank might choose a specific Activity or a child Activity to trigger reward points. The Online Charge attribute triggers the awarding reward points online REWARDS-TRIGGER-<CHARGE> and this Activity is created only for charges that are defined with type as COMMISSION.

- This Property Class has attributes related to amortization, and that results in claw back of amount awarded and also has schedule or frequency related attributes.

- The only difference is that, as a configuration, any claw back activities should not be set up, as in reality it is needed to barely ask back some points for a financial Arrangement not reaching maturity.

- The Property Class created for Agent Product Line will be re-use for the Rewards Product Line. Refer the Agency Commissions user guide product overview section for more information.

- Agent Commission Property is set as Multiple Property Type to accommodate the possibility to have both Agent and Rewards on a same financial Arrangement.

- Also as a configuration, the Product Condition must be set up as non-negotiable as in practice it will be rare to negotiate the number of points at financial Arrangement level on a one by one basis

Refer the Agency Commissions user guide product overview section for more information.

- The same service BNK/AA/AGENT.COMMISSION.SERVICE needs to be running to trigger the points.

- The tables for Agent Product Line are re-used for Rewards:

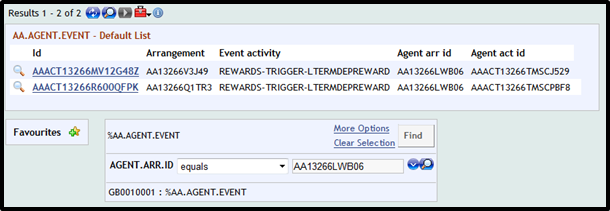

- Read the Technical Tables section in the Agency Commissions user guide for more information on AA.AGENT.EVENT, AA.AGENT.COMMISSION.DETAILS and AA.AGENT.CUSTOMER.

Configuring Rewards Product

The following steps detail the Product configuration for the Rewards Product Line.

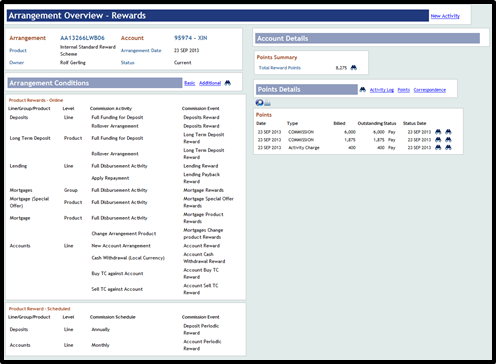

- Click the icons available in Rewards scheme to proceed. The screenshot below shows the Rewards Product Line with the REWARD SCHEME Rewards Group and other respective Products.

The Product Lines page displays the list of available Property Classes in the Rewards Product. Some are defined as mandatory and others are optional.

- Add the balance prefix to the Charge Property Class for Reward Product Line

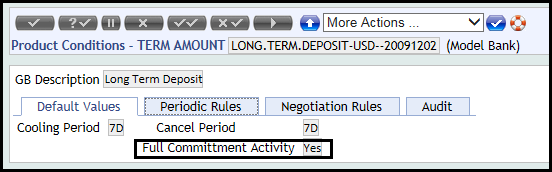

- Setting the Full Commitment Activity attribute as YES triggers the full fund or full disburse Activity on the financial arrangement. The Term Amount Product Condition is shown below.

The Term Amount Product Condition should already be set up as shown in the screenshot, if the agent has been configured.

The Term Amount Product Condition should already be set up as shown in the screenshot, if the agent has been configured. - The Product Group screenshot is displayed below.

A Rewards Product Group is created for Rewards Product Line with the mandatory Property Class.

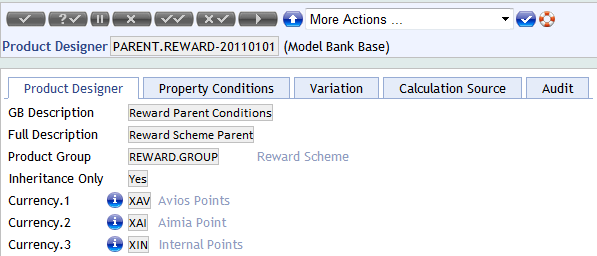

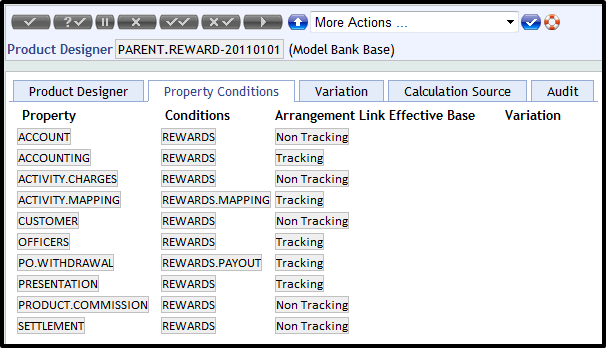

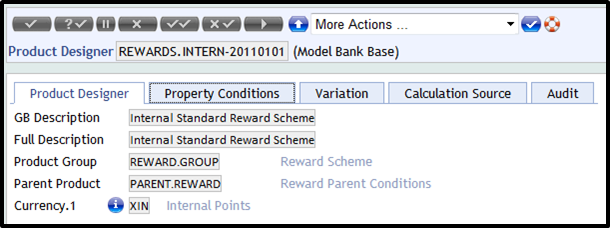

- Create the following Products for Rewards in the Product Designer.

-

In the Reward Parent, a generic Product Condition for the Property Classes (Account, Accounting, Activity Mapping, Activity Charges, Customer, Officers, Payout Rules, Settlement, Activity Presentation and Product Commission) is created.

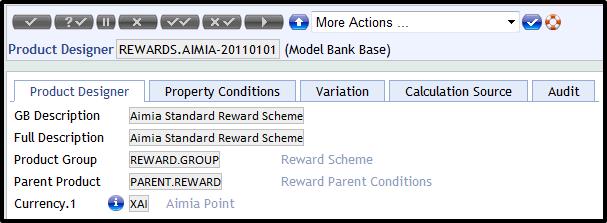

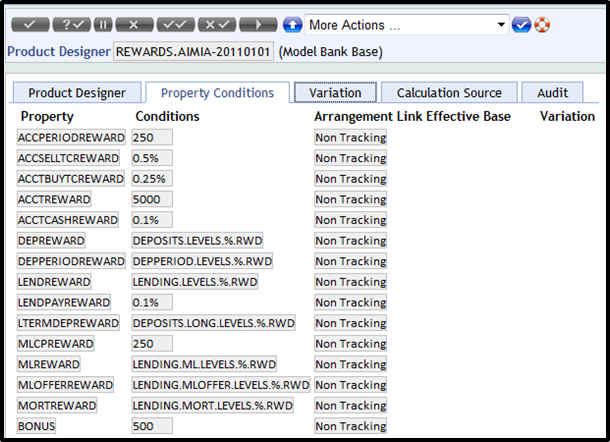

- Aimia Standard Reward Scheme — This Product is linked to the above parent Product.

-

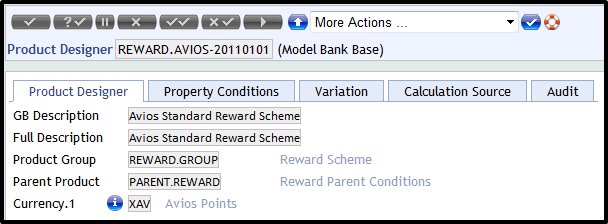

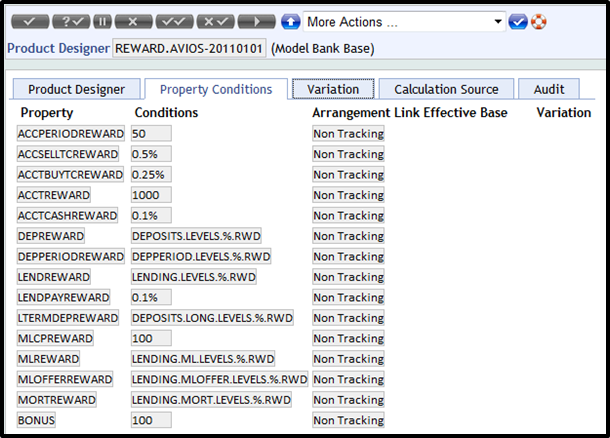

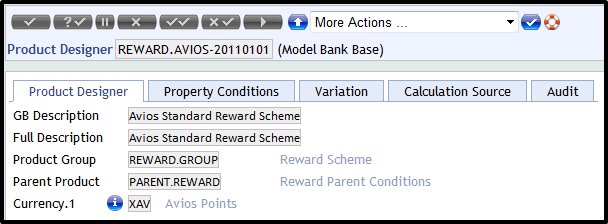

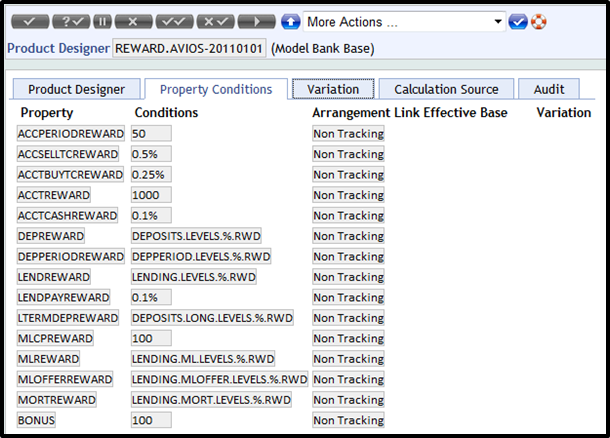

Avios Standard Reward Scheme — This Product is linked to the above parent Product.

-

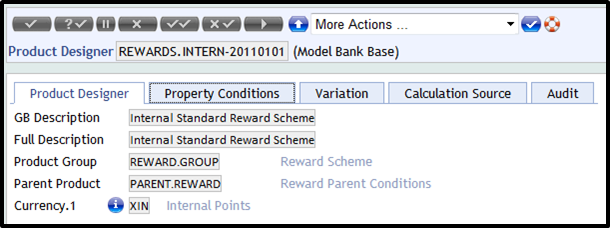

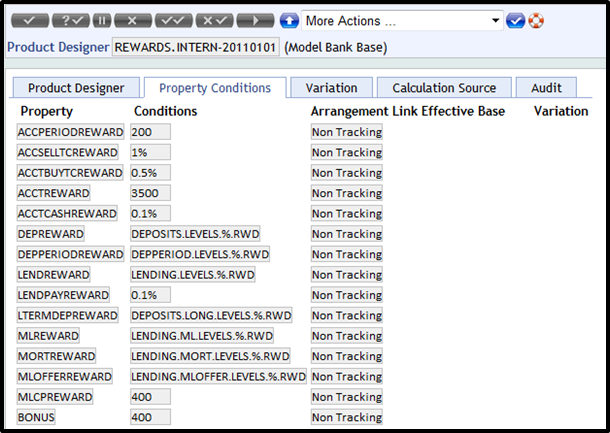

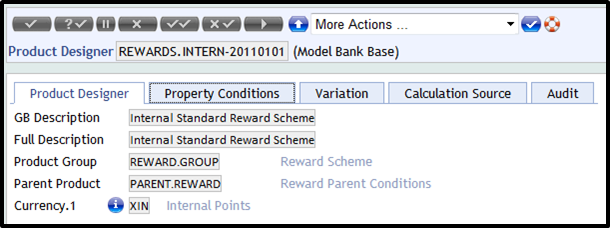

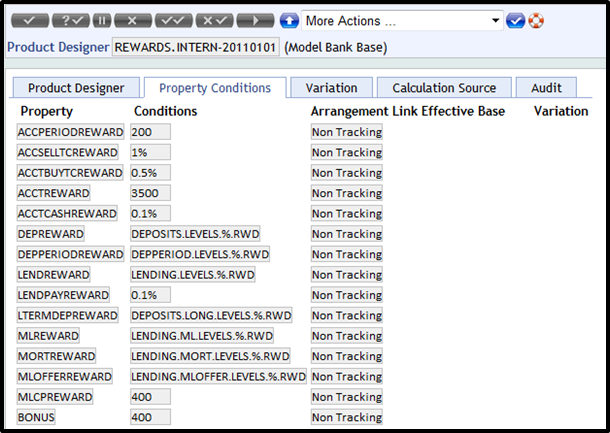

Internal Standard Reward Scheme — This Product is linked to the above parent Product.

-

Avios Standard Reward Scheme — This Product is linked to the above parent Product.

-

Internal Standard Reward Scheme — This Product is linked to the above parent Product.

-

Internal Standard Reward Scheme — This Product is linked to the above parent Product.

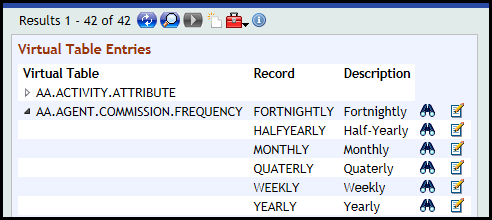

The following EB.LOOKUP records for AA.AGENT.COMMISSION.FREQUENCY are created.

The set up as shown in the screenshot already exists if the agent is configured.

The set up as shown in the screenshot already exists if the agent is configured. -

In the Reward Parent, a generic Product Condition for the Property Classes (Account, Accounting, Activity Mapping, Activity Charges, Customer, Officers, Payout Rules, Settlement, Activity Presentation and Product Commission) is created.

-

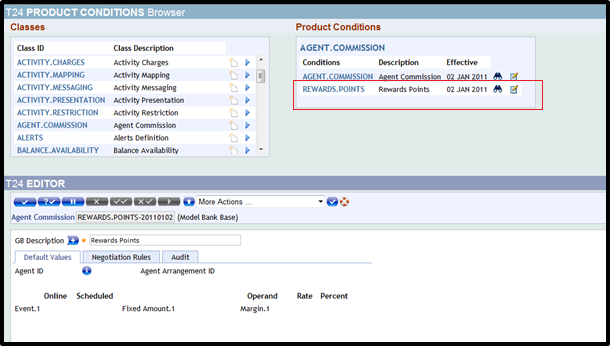

Add an Agent Commission Product Condition to a financial product as shown below. The attributes in this table cannot be defined by the user as the system defaults all values. Negotiation rules can be set for each attribute. However, in the configuration all the attributes are defined as non-negotiable as in practice points are negotiated on financial arrangement.

Financial Product Configuration

The following configuration is for Rewards Products.

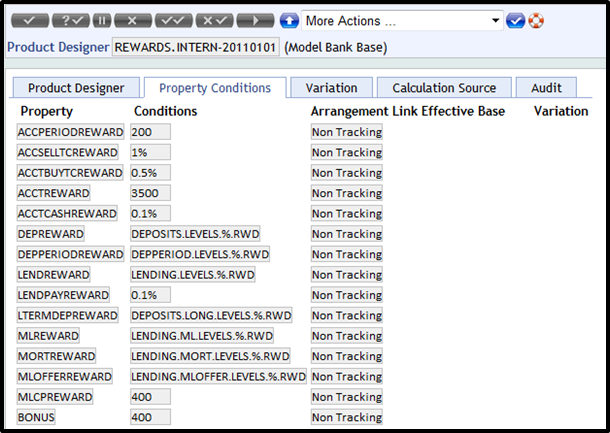

- The following Property records are created for CHARGE, all defined as COMMISSION type, but unlike agent NONE as REBATE UNAMORTISED

- ACCTREWARD – Account Reward

- ACCTCASHREWARD– Account Cash Withdrawal Reward

- ACCTBUYTCREWARD – Account Buy TC Reward

- ACCSELLTCREWARD – Account Sell TC Reward

- ACCPERIODREWARD – Account Periodic Reward

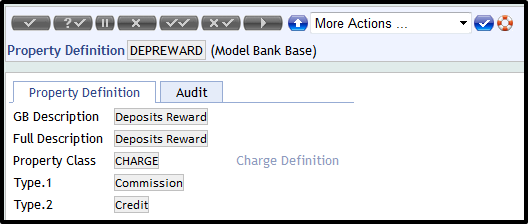

- DEPREWARD – Deposits Reward

- LTERMDEPREWARD – Long Term Deposit Reward

- DEPPERIODREWARD – Deposit Periodic Reward

- LENDREWARD – Lending Reward

- MLREWARD – Mortgages Reward

- MLOFFERREWARD – Mortgage Special Offer Reward

- MORTREWARD – Mortgage Product Reward

- MLCPREWARD – Mortgage Change Product Reward

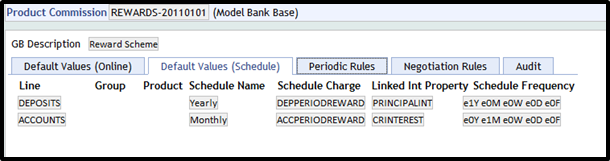

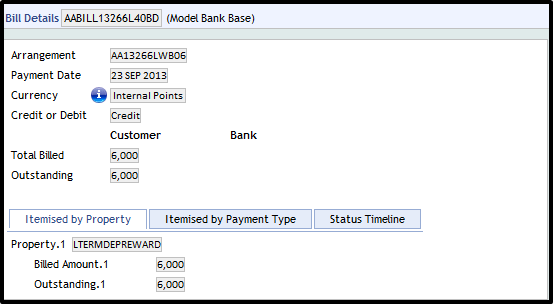

Example of DEPREWARD is shown below.

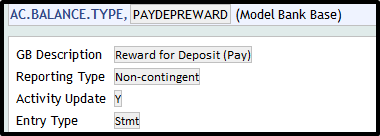

The appropriate AC.BALANCE.TYPE records for the above Properties(prefixed by DUE, PAY and DEF) are released.

Example of PAYDEPREWARD is shown below.

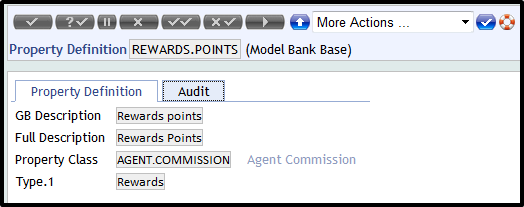

The following Property record is created for Agent Commission.

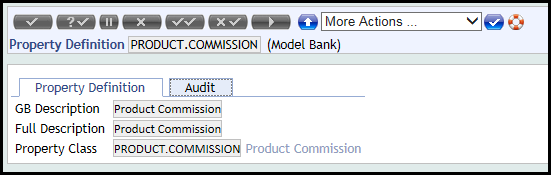

The new REWARDS type is created for the Rewards Product Line. The following Property record is created for Product Commission.

This has already been created if Agent Product Line configured.

This has already been created if Agent Product Line configured. - The following Product Commission Product Condition is created for all the Products (unlike Agent that has a Product Condition for each Product).

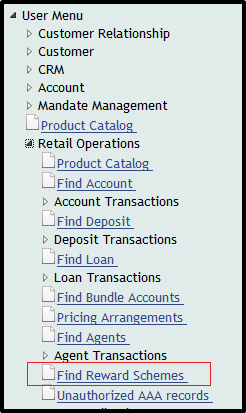

- Proof and Publish all the Parent Products for each Product Line. The Retail Menu is displayed in the following screenshot.

The Agent Products now appear in the Product Catalog.

The following processes are created and attached under the Retail Menu.

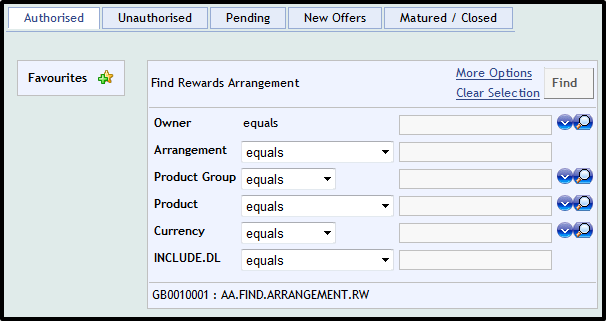

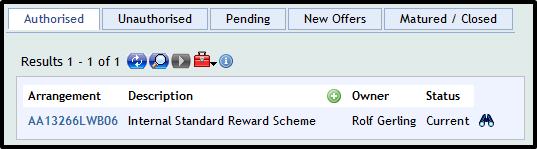

- Use Find Reward Schemes option to launch the Rewards Search Enquiries.

- Reward Overview Screens are created for Authorized and Unauthorized Rewards Arrangements.

The Financial Summary Enquiry is displayed in the following screenshot.

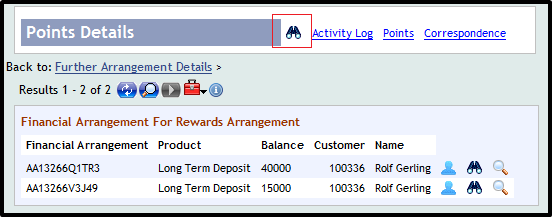

The Connected Account Enquiry is displayed in the following screenshot.

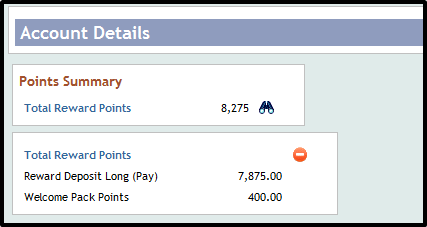

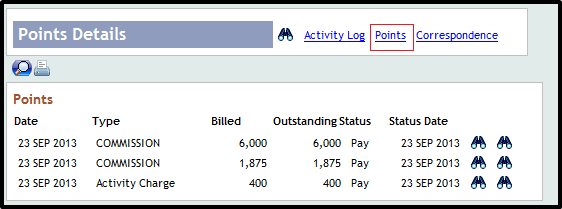

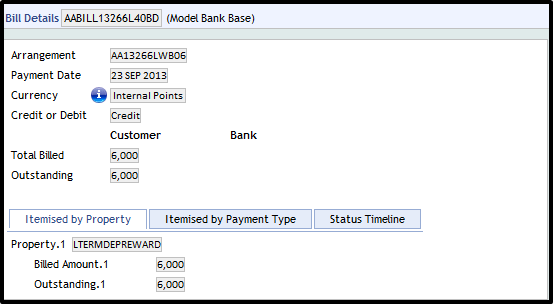

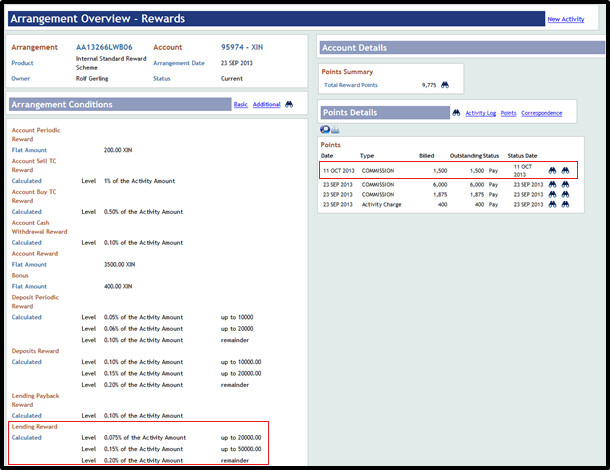

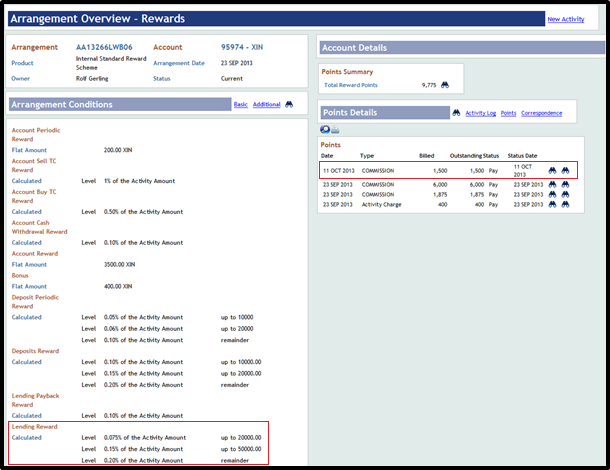

- In the Points Enquiry screenshot below, click the Drill down to display the Rewards Points by bill.

The Connected Account Enquiry is displayed in the following screenshot.

.png)

In the Points Enquiry screenshot, the drill down displays the Rewards Points by bill.

- After proofing and publishing the Parent Products (Rewards Parent and Financial Product Parent), users can then create new Rewards and Financial Arrangement.

- When a new financial Arrangement is created, the attributes, highlighted in the below screenshot, is used to indicate the Reward Arrangement ID that is used for calculation of Rewards Points.

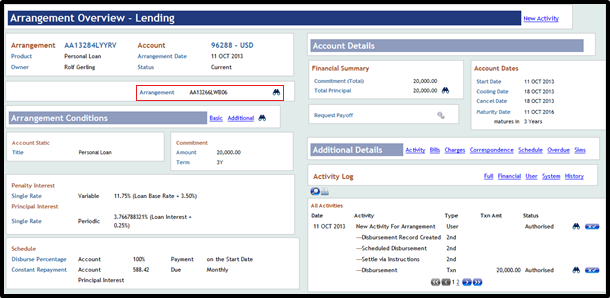

- The following screenshot is the Arrangement Overview – Lending screen of the above arrangement after authorization and full disbursement.

As shown in the above screenshot, the overview displays the linked Rewards ID Arrangement.

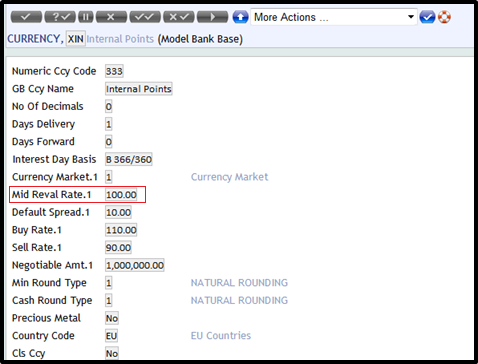

- The above Personal Loan for 20,000 USD produced 1,500 Points to the rewards scheme which was calculated as 0.075percentage of the total amount (15 USD) and then converted in the points currency XIN (Mid-rate considered: 100).

Key Aspects of Property Class in Rewards

- The Account Property Class is mandatory for the Rewards Product Line. It indicates the account number and does not hold any financial balances for the Rewards Product Line.

- The Payment Rules Property Class is not available in Rewards Product Line as there is no debit balance for rewards. Rewards is offered as an add-on bonus to the customer. Thus, the Tax Property Class is also not available for Rewards.

- The Payout Rules Property Class is mandatory. Redemption of reward is handled by using this Property Class.

- Bill type for rewards through regular Activity charges continue to be ACT.CHARGE.

- Bill type for the Rewards awarded by financial arrangement is COMMISSION.

- These bill types have are configured in AA.PAYMENT.RULE.TYPE used in PAYOUT.RULES for rewards arrangement.

- The Product Commission Property Class is also mandatory. It defines the Activities that offer reward points.

- PAY type CHARGE Property or PERIODIC.CHARGE Property can offer reward points.

Illustrating Model Parameters

The Product Conditions of a Property Class are evaluated to bring out the features of the Property Class. The system defaults the values in the Product Condition in an arrangement (during its creation). The negotiability or default values and other restrictions are also defined in the Product Condition. These Product Conditions along with the properties derived from the Property Classes are grouped together to build the products.

The Product Conditions are dated and some of them have currency as part of their ID. When the currency forms part of the Product Condition ID, then the user needs to create different conditions for each currency in which the product is available. When a new condition is created or an existing condition is amended, the product to which the condition is linked has to be proofed and published.

The Model Parameters consists of:

This Property Class is used by all products which are account based. This property class primarily controls the description of the account. The Account property allows the user to define and control balance treatment, posting restriction, linked account number (for memo accounts), currency market, date convention related setup for the account.

Although account names are typically account specific, then system can default generic titles from the product and can be replaced or given additional detail at the arrangement level. Each Temenos Transact product defined and processed in AA can have a single Account Property defined.

This property class is used in Agent or Reward Product line. The same is used to configure financial product line or product group or products, that are eligible for commission calculation, besides defining if the commission has to be paid immediately or is scheduled. The setup also allows definition to specify if claw-back of commission has to be done.

This property class is used by various product lines, which have amounts billed and made due for payment to the customer. This is used to define the method by which a single payment is applied to multiple bills and amount types.

Illustrating Model Products

The Retail Rewards Product Line provides various Rewards scheme functionality for Temenos Transact. The module allows the user to create Aimia Standard, Avios Standard and Internal Standard Reward Scheme using the AA framework under the Rewards Product Line.

|

S.No |

Product Name |

Product Attributes |

|---|---|---|

|

1 |

Reward Scheme |

|

In this topic